Navigate complex incentives, minimize tax liability, meet regulatory compliance, and optimize building design with Walker Blue.

As a national leader in energy tax incentives and energy engineering, Walker Blue works with commercial, residential, industrial and institutional clients nationwide.

We specialize in 179D and 45L tax certifications, ITC, domestic content, and prevailing wage compliance, and provide comprehensive energy engineering services.

By combining technical rigor with industry-leading insights, we support clients in achieving their energy efficiency and sustainability objectives while significantly enhancing their bottom line.

Find the right solution for your organization →

Leadership Team

Connect With Us At An Industry Event

Join an Upcoming Webinar

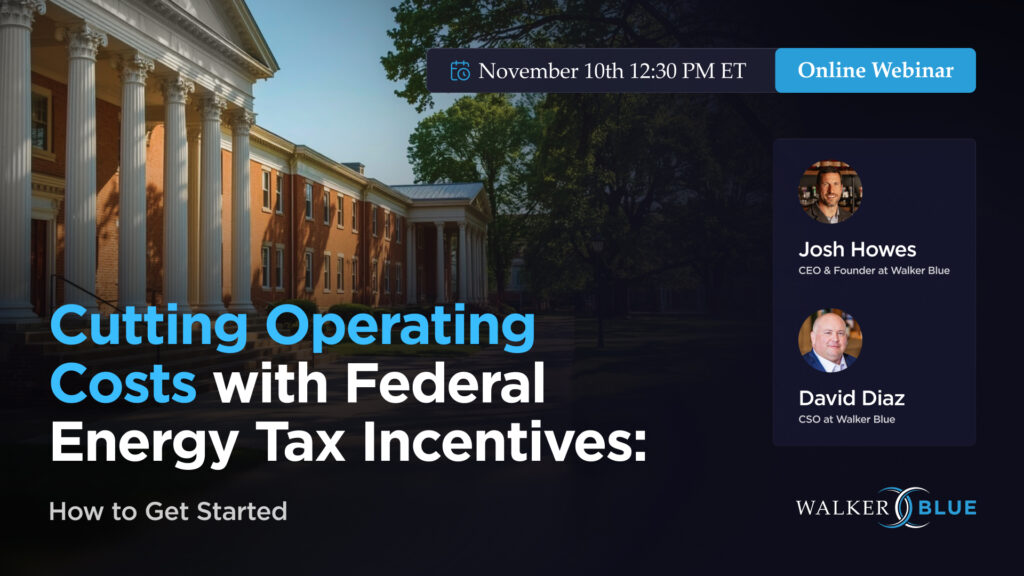

Cutting Operating Costs with Federal Energy Tax Incentives: How to get started

This session explains how Elective Pay under the Inflation Reduction Act—maintained through the One Big Beautiful Bill Act (OBBBA), gives government and nonprofit organizations a time-limited opportunity to convert federal energy tax credits into cash payments. Learn how these funds can directly support facility upgrades, reduce operating expenses, and advance energy efficiency and sustainability goals.

Register